For decades, China has been a global growth engine, driving the world economy forward with its rapid industrialization, expanding middle class, and insatiable appetite for commodities. However, in recent years, a series of structural issues have begun to surface, threatening to undermine the stability and growth of the world’s second-largest economy. Let’s delve into the real economic crisis facing China, exploring the key factors contributing to this downturn and what it means for the global economy.

1. Debt Overhang: A Looming Shadow

China’s economic growth has been heavily fueled by debt. Both corporate and local government debts have ballooned over the past decade, reaching unsustainable levels. According to recent estimates, China’s total debt-to-GDP ratio has surpassed 280%, a figure that raises concerns about the country’s ability to manage and service its obligations.

Local governments, in particular, have been caught in a debt trap, financing infrastructure projects and real estate ventures that have not yielded the expected returns. The proliferation of shadow banking and off-balance-sheet lending has exacerbated the problem, creating a complex web of liabilities that are difficult to unwind without causing significant economic disruption.

2. Real Estate Woes: The Evergrande Effect and Beyond

The collapse of property giant Evergrande in 2021 was a wake-up call for China’s real estate sector, which had been a pillar of the country’s economic growth. Real estate and related industries account for nearly 30% of China’s GDP, making it one of the most crucial sectors for economic stability.

However, years of speculative investment, over-leveraging, and an oversupply of housing have led to a severe correction. Property prices have fallen in many cities, leaving developers and homeowners alike in financial distress. The government’s attempts to rein in speculative bubbles through regulatory tightening, while necessary, have further dampened sentiment, causing sales and new projects to plummet.

3. A Demographic Time Bomb: Aging Population and Shrinking Workforce

China’s one-child policy, implemented in 1979 and relaxed only recently, has led to a rapidly aging population and a shrinking workforce. The country’s working-age population peaked in 2011 and has been declining since, posing a significant challenge to future economic growth. An aging population not only strains public resources through increased healthcare and pension costs but also reduces the labor pool, driving up wages and reducing competitiveness.

The government’s efforts to encourage higher birth rates have so far fallen short, with many couples citing high costs of living and child-rearing as deterrents. This demographic shift is expected to place a substantial burden on China’s social safety nets, which are already under pressure.

4. Trade Wars and Geopolitical Tensions: A Fragile Balance

China’s economic rise has not been without friction on the global stage. Trade tensions with the United States, most notably the trade war initiated in 2018, have disrupted supply chains and led to tariffs on hundreds of billions of dollars’ worth of goods. While there have been attempts at negotiation, relations remain strained, with broader geopolitical issues such as technology competition, human rights concerns, and regional security disputes further complicating the landscape.

These tensions have prompted China to accelerate its “dual circulation” strategy, aiming to reduce dependence on foreign markets by boosting domestic consumption. However, shifting an economy as large and export-oriented as China’s will take time and may not fully offset the external pressures in the short term.

5. The Technology Crackdown: Unintended Consequences

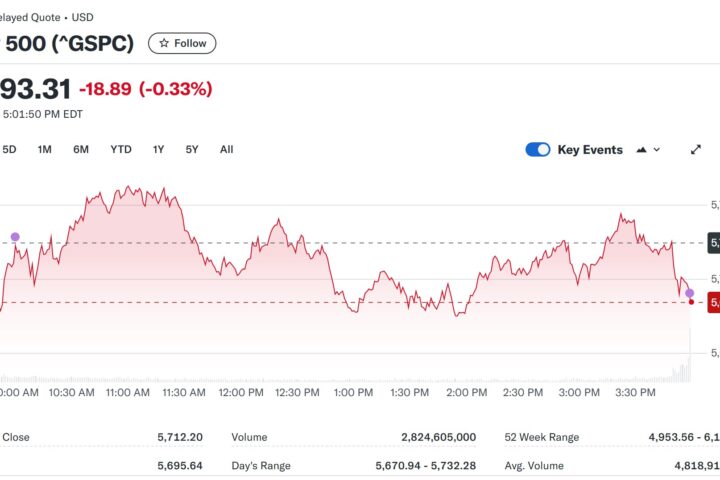

China’s regulatory clampdown on its tech giants, such as Alibaba, Tencent, and Didi, has sent shockwaves through the industry. While the government aims to address issues like data security, antitrust violations, and financial risks, the abrupt and severe nature of these interventions has spooked investors and curtailed innovation. The crackdown has wiped out hundreds of billions of dollars in market value and created uncertainty about the future of private enterprise in China.

This regulatory environment, if not carefully managed, could stifle the very sectors that are crucial for China’s transition to a more advanced, innovation-driven economy. Balancing state control with private sector dynamism will be key to navigating this challenge.

6. Environmental Challenges: Balancing Growth and Sustainability

As China grapples with its economic issues, environmental sustainability has emerged as another critical concern. The country is the world’s largest emitter of greenhouse gases and faces severe pollution problems that affect the health of its citizens and the environment. The push for greener growth, while essential, requires substantial investment and could slow industrial output in the short term.

China’s commitment to achieving carbon neutrality by 2060 is ambitious, but the path to that goal involves difficult trade-offs. Reducing dependence on coal, transitioning to renewable energy, and modernizing heavy industries will require careful planning and significant financial resources.

Conclusion:

Navigating the Uncertain Road Ahead

China’s economic challenges are complex and multifaceted, involving a delicate balancing act between maintaining growth, managing debt, and implementing necessary reforms. The government’s ability to navigate these issues will have profound implications not only for China but for the global economy at large.

While China has shown resilience in the past, the real economic crisis it faces today requires more than just short-term fixes. Structural reforms, innovative policy solutions, and a strategic approach to both domestic and international challenges will be essential for steering the economy toward a sustainable and prosperous future. As the world watches closely, the coming years will be critical in determining whether China can overcome its economic hurdles or whether it will face a prolonged period of stagnation.